There have to be downsides, after all, there are for every other investment. So,

Here Are 9 Legitimate Reasons Silver Is A Bad Investment:

-

Price Fluctuation (volatility)

-

The Ability To Buy Fake Silver

-

Storage Fees

-

Deflationary Events Can Drastically Lower The Value

-

Potential For Loss, Theft, Or Damage

-

There Is No True Price Per Ounce

-

Value Can Change Based On Fear Just Like Stocks

-

Silver Doesn’t Pay You Dividends

-

You Have To “Time” The Market To Make Big Gains

At the very least knowing what makes silver a bad investment can HELP you invest in Silver. It will help you avoid the common pitfalls and get a better (or actual in some cases) return on your investments.

What Is The Cheapest Way To Buy Silver?

Price Fluctuation (volatility)

It’s no news that Precious metals are volatile and the price can fluctuate wildly. This can work in your favor or against.

Even if people have a lot of experience in the commodities market, emotional investing tends to be a part of buying and selling. Buying high and selling low is a real problem you need to contend with.

When you have an investment like silver (which has historically been very volatile) you need to be as sure as you can that you’re buying low and selling high. This seems obvious but because people invest emotionally it can be challenging to know when to buy and when to sell.

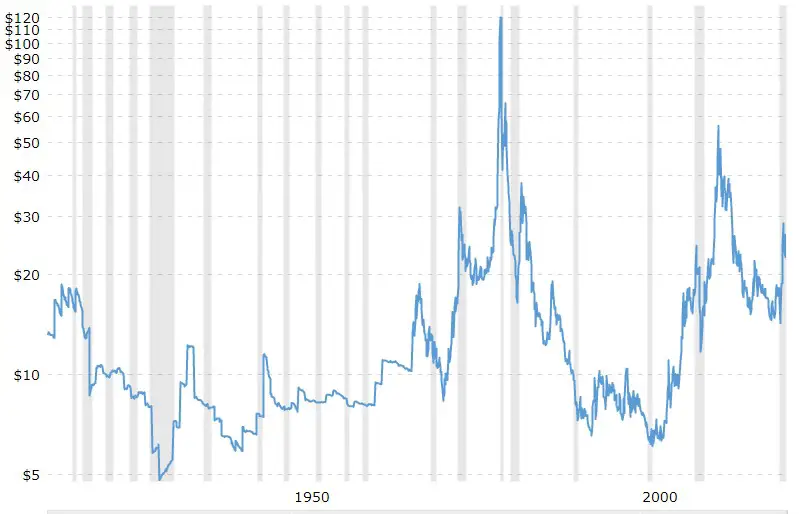

A Historic Chart from Macrotrends illustrates how much the price of silver can change in a very short period. Silver Prices – 100 Year Historical Chart | MacroTrends

As you can see, there have been major spikes in price over time. for example, in August 2001 the price of silver was $6.16 and by 2008 it was $24.47. That’s a 290.24% return in 7 years.

It wasn’t all good news though, because, in 2008 the stock market crashed and the price of silver dropped to $11.71 by October. That’s a 52.15% loss in 8 months.

If you want a stable investment that can make you more reliable returns over a long period there are other options available.

To make it easier, you can start investing with a Robo-Advisor and make a custom investment profile to suit your risk level, take a look.

The Ability To Buy “Fake” Silver

Believe it or not, you can invest in silver without actually owning any silver. This might seem far-fetched but it happens all the time and people don’t even realize it.

Silver ETF

Investing in a Silver ETF allows you to get exposure to the market but when you invest you aren’t purchasing the physical commodity. This creates new potential gains and potential danger.

On top of Silver ETFs such as the iShares, SIL not giving you physical exposure, there are fees associated with running the Fund.

Most fees are low, like SIL ETF, which has an expense ratio of 0.5% per year. With major volatility in silver value the potential to lose value from a drop in silver price and then pay fees on top adds to the downside risk of investing.

Silver Coins

While having a silver dollar may seem like a great investment, it is based more on the collector’s value than silver bullion.

Most silver dollars aren’t 99.99% silver. They tend to be close to 60% silver. When you try to value the coin it can become challenging.

Silver dollars are a collector item and aren’t pure silver, so knowing their value isn’t solely based on the physical price of silver. It is based on the collectible value of the coin as well as the physical composition.

It’s easy to buy silver dollars and it may seem like a good deal because they are slightly cheaper than their bullion counterparts. Just understand that the value can be harder to judge and it is more of a collector item because it isn’t pure silver.

Are Silver Coins The Cheapest Way To Buy Silver?

Not So Honest Business’s

An unfortunate truth is that not all companies are honest. The vast majority are but some deal a little too far into the shadows.

It happens a lot, where an investor purchases silver from a dealer and pays for storage from the same company. This is convenient and can make the investment simple.

But there is one potential problem, they may not store physical silver for you. Some companies have been found to “store” I Owe You’s for their customers rather than having huge vaults full of customers’ physical bullion.

This is a scary situation for you as an investor. Generally speaking, if you are buying silver for a long-term investment you wouldn’t even realize it.

At some point you would request for your investment to be sold and given the cash from the sale but if there is ever a time that a lot of people want their silver from the business they wouldn’t have enough physical silver to fulfill their obligations.

Storage Fees

Buying physical silver is one of the safest ways to invest in silver but there are drawbacks. You won’t be paying management fees like when investing in an ETF but you will have to store your physical silver somewhere.

This can add a challenge to your investment because a lot of us don’t have a safe in our home or a safe deposit box at a bank.

To buy a safe or rent a safe deposit box at a bank costs money. This can be a monthly recurring cost that eats away at your potential returns.

Fees for renting a Safe Deposit Box can range from $20 to $200 a year depending on the size and location.

But a good secure safe can run into the thousands of dollars to purchase and move into your home.

Most companies offer a storage option for your bullion so you don’t need to worry about storing it yourself but, again, this is a long-term expense eating away at your investment returns.

Deflationary Events Can Drastically Lower The Value

Gold and Silver hedge or protect your money from inflation because both are oppositely correlated. As the value of each dollar goes down (inflation) the value of Silver will increase.

Gold and silver have a positive relationship with implied volatility, supporting the idea that investors perceive precious metals as safe-havens, to be purchased in anticipation of rising equity market volatility.

VIX, Gold, Silver, and Oil: How do Commodities React to Financial Market Volatility? Daniel Jubinski Saint Joseph’s University Amy F. Lipton Saint Joseph’s University

This is how you end up with a higher price per ounce. While this is a good thing and drives the price of silver up as well as the overall economy, inflation needs to be balanced.

It is also where deflation can hurt your investment. While inflation makes each dollar worthless over time, Deflation makes each dollar worth more.

Because Silver is oppositely correlated to inflation, the price of silver can go down in economic hardships. (deflation)

For a good overview of how hedge funds protect investments have a look at my previous post.

This was the case especially through the great depression where the price of silver went from $18.17 in 1919 to $4.75 by 1930.

Since there is always the potential for market corrections where deflation has a strong impact it is always a risk that the price of silver can crash based on world events.

Having a great place to store your cash during deflation is very important. A Money Market account offers higher interest and still provides you access to your money. Have a look at CIT Money Market Account and be ready when market volatility hits!

Potential For Loss, Theft, Or Damage

Since Silver is a physical commodity, there is potential for someone to steal it and with it your investment. This can be mitigated by holding it in a safe or at a bank but there are other potential dangers like damage or loss.

Since silver bullion can be minted into coins or bars, you may have it stored in a safe but a fire can do a lot of damage that can be very hard to recover from.

Coins and bullion are minted with the purity and authenticity made right into them. Fire poses a real threat to your investment.

In only 3 1/2 minutes, the heat from a house fire can reach over 1100 degrees Fahrenheit.

Silver has a melting temperature of 1,763 Fahrenheit but it is possible to melt or damage your investment.

Even if a house fire doesn’t melt your silver it can melt other items onto it or leave acidic soot or film which can eat into the surface. This is seen a lot more with silver “pieces” such as plates, cutlery, etc.

Also, while less common for an investment, there is still the potential that you lose your coins or bullion.

There Is No True Value Per Ounce

While you can go onto Google and get the Live price of Silver at any given moment. The price per ounce is only what people are willing to give you at that moment.

Supply and demand play a role and other factors like emotion and leverage. Because Silver is a commodity it cannot be backed by information like a business can.

A business has an intrinsic value based on income, expenses, and how much profit it can generate. Silver’s price can only be influenced by outside forces.

To learn about financial analysis I recommend starting with The Beginners Guide To Financial Statements

By not being able to validate the price of silver-based on data, ex, financial statements, you have to rely on many factors from many different places.

The monetary policy, overall market cap, the buffet indicator, gold to silver ratio, silver to (insert market) ratio, etc.

Value Can Change Based On Fear Just Like Stocks

Fear is a powerful force in the precious metals market. It can swing prices violently and can sometimes be completely irrational.

But the hardest part with fear is that the price of silver can go either way, up or down.

that people tend to overreact to dramatic news and events, regardless of whether these events are positive or negative. This would lead to excessive optimism over good news and extreme pessimism over bad news (De Bondt and Thaler, 1985, 1987). As a result, prices tend to overshoot, causing mispricing to occur.

Am´elie Charles, Olivier Darn´e, Jae H. Kim. Will precious metals shine? A market efficiency perspective. International Review of Financial Analysis, Elsevier, 2015, 41, pp.284-291. <10.1016/j.irfa.2015.01.018>.

When people are scared they can dump their silver because they need the money to live or they can start buying the metal in hopes of saving their money from inflation or other forces.

A prime example just happened with Covid 19. The price of silver investments crashed right alongside the overall market. People needed their money to live and therefore liquidated stocks and holdings.

Beyond just sock and holdings, people started selling their physical silver. But there was still more. with factories and production halted, silver was no longer being used to create products.

All of this creates a surplus of silver-based investments lowering the price.

Silver Doesn’t Pay You Dividends

Outside of investing in some silver mining companies the physical silver won’t pay you any income (dividends)

Having an investment that is solely relying on appreciation (increase in value) can dull the appeal of investing. You will have to either create a cash flow from somewhere else if this was your retirement money or sell your silver to create cash.

There are multiple income streams and ways to generate income but if you have to sell your assets to generate income to live you can find yourself running out of assets to sell.

Combined the volatility that silver has shown over many years and you can end up selling for less and less money just to live.

You can of course expose yourself to other investments such as ETFs or specific stocks in the silver market but their overall increase in share price will always be correlated to Silver spot price.

This means that even if you invest in silver mining stocks that pay dividends if the price of silver goes down, the miners’ income goes down resulting in a decrease in stock price and overall dividend payout.

How Passive Income Can Make You RICH!

You Have To “Time” The Market To Make Big Gains

Going back to the 2001 to 2008 bull market for silver, the only way you can have the full benefit from that boom is to try and time the market and assume the top and bottom for buying or selling opportunities.

Seeing as it’s virtually impossible to predict any market this is a potential problem.

There are ways to try and evaluate when to buy and when to sell but there is no way to know exactly when the bottom has come and created a good time to buy.

Therefore, dollar cost averaging is your best tool to forgo timing and continue to benefit from the price drops.

Using ratios like the Gold to Silver Ratio and Silver to S&P500 Ratio can give you an idea of potential gains or loss but it isn’t a perfect system.

There are just too many variables to accurately predict the exact time to buy or sell.

Conclusions

While Silver can be a great asset addition to anyone’s portfolio, there are some drawbacks to silver investing that need to be addressed and compensated for.

From market manipulation, shorting ETF’s or storage fees eating away at the potential return you need to make sound decisions on how you start investing in silver.

Understanding that cash flow is important and that not all assets are created equal, you can make some serious returns on your money!

Ways to make 10% or more investing!

Be careful trying to buy rare coins. If you send a want list and a check the dealer will send you comman coins and say he is out of the others you ordered. All you get is nominal coin not worth what you payed Deal with a brick and mortar shop in your neighborhood

If auther wanted me to stop investing in silver – they failed. But if author wants to dispute it further, I would like to invite them to reddit.com/r/wallstreetsilver subreddit for further debate.