Purchasing a home is one of the biggest financial decisions people make in their lifetime. It is a decision that has two sides, the good and bad

Buying a house is a bad investment because mortgages are designed to make the lender money not the homeowner. A house also opens the owner(s) to liability risks and upkeep costs with no favorable tax benefits. . Also, Personal Real Estate holds a risk of losing value, doesn’t produce cash flow, and only appreciates in line with inflation.

Mortgages Are Designed To Make Lenders Money

It’s no surprise that banks and money lenders are trying to make money. So when you need to borrow money to purchase a house or other real estate it’s normal to pay interest on these loans or mortgages.

Even though mortgage rates have been on a steady decline since the late ’70s, having a long-term liability is costing you a lot of money.

Interest isn’t the only downside to owning a home. The structure of a mortgage, the upkeep, and multiple other downsides plague a homeowner’s investment.

You Pay The Interest First On Your Mortgage

The most common mortgage that people get from a lender is a fixed mortgage for 25 to 30 years. During this time you renew your mortgage multiple times in 1 to 5-year increments.

When you renew, most people borrow money at a fixed interest rate for a set term. This may be one year or could be as long as 10 years.

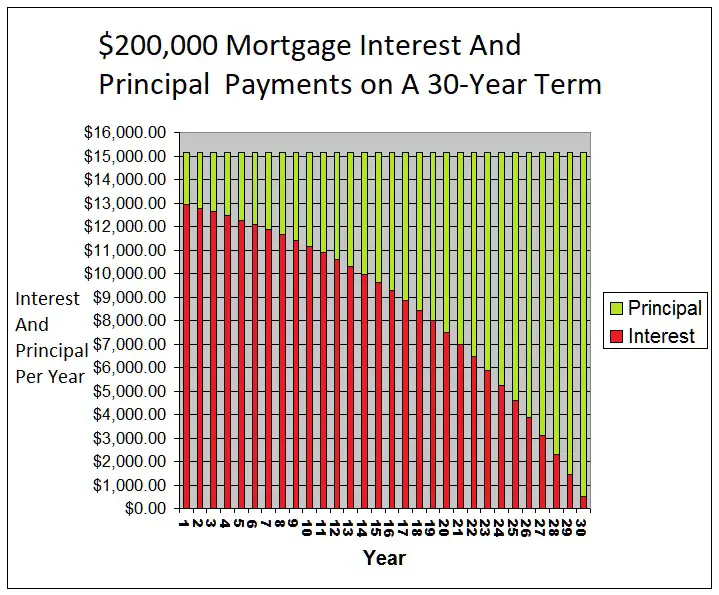

The payment structure of a fixed-rate mortgage sets you up to pay the lender most of their interest at the beginning of your 25-year mortgage amortization.

This means that throughout the first half of your mortgage you aren’t gaining any substantial equity.

As you can see, the first several years of paying a mortgage you are paying mostly interest. although you are gaining a little equity it isn’t until the latter half of the mortgage amortization that you start to make any real progress.

People Move Every 8 Years And Therefore Don’t Gain Equity

The average family ends up moving to a new home every 8 years. This greatly affects their ability to create equity in a home.

In the first quarter of 2019, homeowners who sold their homes had owned them an average of 8.05 years, down slightly from a record high of 8.17 in the fourth quarter of 2018

Average Homeowners Stay 8 Years Before Moving | Realtor Magazine

While this is normal if you have a home with a mortgage, every time you move you start the interest first payment process over again.

Remember back to the graph of interest and principal payments. The first few years you end up paying a lot of interest. By moving every 8-10 years you end up never gaining a lot of equity and always pay the lender significant amounts of interest.

It makes sense why people move so often, first, they get a starter home which after about 8 years they have mostly outgrown. A family and better careers make it so they need to get a nicer, bigger house.

Then after getting the bigger house they raise any kids that might come along, perhaps have to move again depending on the number of kids. But after the kids are gone it’s common to have too much house, and you might downsize.

For years the constant flow of new mortgages makes it so you are paying the high-interest portion of your mortgage much longer.

Mortgage Insurance Protects The Lender

If you start a mortgage and pay less than 20% of the value as a down-payment your lender will require you to have mortgage insurance.

Mortgage insurance protects the lender in case the homeowner defaults, dies, or gets seriously ill.

This is good for the homeowner only because his/her family won’t have a mortgage to deal with should they die but it also protects the lender’s investment.

The lender gets paid the remainder of the loan and is free of debt you can no longer pay.

The bank gets their money no matter what, and YOU pay for the insurance on THEIR investment.

This is potentially thousands of dollars a year you have to pay to protect the bank or lender.

Have a look at the 3 part series of What You Don’t Know About your Mortgage to see other facts!

There Are Liability Risks To Home Ownership

Being a homeowner has potential dangers in other ways than just monetary.

If someone is hurt on your property you can be liable for the injury. This includes public sidewalks and other areas.

It is up to the homeowner to make sure that their property is safe and free from any negligence that can cause injury.

You can of course have insurance to protect you in the event someone sues you for being injured, but this adds to the cost of being a homeowner.

Expensive Upkeep Costs Of Owning A House

Having a home requires you to take care of it. If you neglect to do repairs or yard upkeep your home value will go down and things will start to break.

Without the proper maintenance, many things in your home will slowly fail. Your roof will start to leak, facia may come loose.

Your furnace may break or run inefficient costing more to heat your home. Also, simple things like keeping your AC condenser outside clear of leaves and debris.

Some of those maintenance things may seem big but there is also a constant need to keep up with yard work like cutting the grass, pulling weeds from the landscaping, picking up sticks, and trimming trees.

After all this work it may seem like you have created another part-time job, especially if you have a large property or multiple properties.

For Saving Money you should be using an excellent account such as a CIT Money Market Account or a CIT Savings Account.

This will give you the best rates and allow you the flexibility to afford homeownership!

There Aren’t Any Favourable Tax Benefits

Businesses get favorable tax benefits for purchasing and running income properties but homeowners do not. You aren’t running a business so you have limited perks.

You won’t be able to depreciate your property saving taxes, nor will you be able to write off any repairs.

This means you will end up paying the highest price to be able to do any repairs or maintenance. While most people don’t run their home through a business, some people do and get to use the perks of a business to their advantage.

You can start a small business and be able to write off a small portion of your home expenses but it is limited because it is also your primary residence, not just a business location.

Real Estate Holds Risk Of Losing Value

As with any investment, there is a real risk that the value of your home goes down. You CAN lose money buying a house.

It is very common for people to believe that their home can’t go down in value but 2008 proved that not to be true. Market corrections or market crashes do happen. Look at the 2008 crash and how much value was lost very quickly.

Via macrotrends

People can be left in ruin or unable to afford their homes.

After the housing market crashed and people started to lose their homes the value of people’s properties dropped thousands of dollars in a few short months. Anyone who had a mortgage with little or no equity was paying for a house that they wouldn’t be able to sell and pay off their mortgage.

If someone bought a home for $200,000 and the overall housing market lost 10%, the value of the house is now $180,000.

But this puts you in a bad position.

You would still be required to pay your mortgage payment based on $200,000 but if you couldn’t afford it because you lost your job. Selling the house wouldn’t provide you with enough money to pay off your mortgage either.

This scenario caused a lot of people to go bankrupt and is worth knowing if you want to become a homeowner.

Buying A House Doesn’t Produce Cash Flow

Houses are expensive, upkeep is expensive, heating is expensive, everything just keeps taking money from your pockets when you own a home.

Although your house is an Asset, it is also a Liability because you owe money on it.

Read: Why Not All Assets Are Created Equal!

When you invest your money you want to be able to make more money with your investment. You don’t want to invest and lose money.

But investing in a house will cost you money every month, from interest to upkeep, and won’t produce any income.

Having $500,000 in a house costing you money every month is much less valuable than having $500,000 investing in cash-flowing Assets like dividend stocks.

One of the biggest investments you will make is in a house and it will cost you money, not, make you money.

Have a look at how you can MAKE MONEY from Twitter even if it’s while you save up to buy a house.

Housing Appreciation Follows Inflation

Over the long run, the cost of houses has steadily increased but not because the house is worth more.

No, the house is worth the same amount today as it was when it was built 30 years ago. The reason you get more money for houses over time is that house prices follow with inflation.

Inflation is your money, losing buying power over time. In an ideal world, inflation would be 2% a year.

To get an idea of how that 2% inflation will affect your money, imagine you have $100,000 hanging out in a money market account because it makes more interest than your savings account.

TIP: CIT Money Market Accounts offer an amazing rate for you to save money!!!!

You find a house worth buying and it’s worth $100,000, yay you have enough to buy it but you don’t right now you are going to wait.

Next year the house is still on the market but now it’s worth $102,000. That’s 2% inflation in action.

Although you still have the $100,000, it is no longer enough. It’s not just house values either, heating and cooling, food, gas, insurance, all of these expenses go up as well.

Having A Home Is Important Just Understand

You need somewhere to live, so although having a house can be a bad investment, it is a necessary obstacle to contend with in life.

Find a way to afford a house and not become house poor, which is when you are paycheck to paycheck and if you get hit with an unexpected bill it could hurt you.

This “living within your means” is a saying beaten to death these days but the only other option is to increase your income.

How To Get RICH Working For Someone Else!

Create your own reality and live an extraordinary life, just make good investment choices!

I had to laugh at the moving every eight years. I’m sure that is true on average but we’ve been in this house for forty years, its the only one my wife and I have ever owned. Because I bought a house that cost only one years entry level wages and gradually added on and improved it over time we never had high payments and easily paid it off early. We raised three kids from birth to successful adulthood in this house. There was never any risk because, as you recommended, we did not buy outside of what we could easily afford. There is something awesome, and hard to explain about living for decades in one house. It is kind of sad that so few people get to experience it.