There are a lot of people who are working Part-Time and trying to make ends meet. If you are considering getting a Part-Time job knowing how much you will likely be paid can help in finding the right position for you.

The average Part-Time Salary in Canada for 2019 was $17.25 per hour or, $21,562.50 per year, working 25 hours a week for 50 weeks. The average After-Tax Income of Part-Time Workers in Ontario was $18,833 with a Marginal Tax Rate of 20.05%.

There are a lot of reasons people work Part-Time, it may be because you couldn’t find suitable Full-Time work or you may be in school. Either way, working Part-Time has many benefits and can increase people’s quality of life significantly.

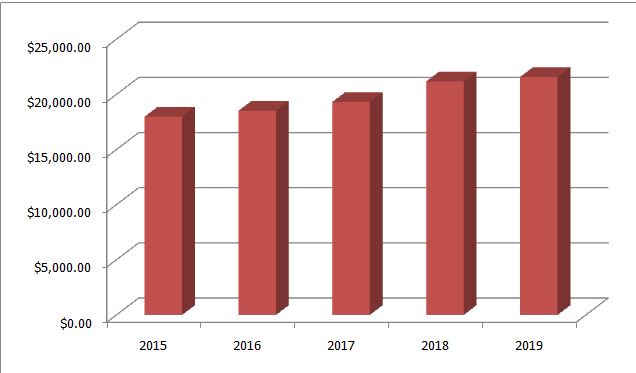

Average Part-Time Salary for 2015-2020 (Quarters 1-4)

Compiled from Stats Canada

| Year | Average hourly wage per year | Yearly wage 25h/week | Q1 | Q2 | Q3 | Q4 | Yearly Wage Growth |

| 2015 | $14.37 | $17,962.50 | – | $14.60 | $14.00 | $14.50 | |

| 2016 | $14.80 | $18,500.00 | $14.30 | $14.95 | $15.05 | $14.90 | 2.99% |

| 2017 | $15.44 | $19,300.00 | $15.55 | $15.20 | $15.45 | $15.55 | 4.32% |

| 2018 | $16.93 | $21,162.50 | $17.00 | $16.95 | $16.90 | $16.85 | 9.65% |

| 2019 | $17.25 | $21,562.50 | $17.60 | $17.20 | $17.15 | $17.45 | 1.89% |

Over the years of 2015 to the end of 2019, the average wage has been increasing at a surprising rate, with 2017-2018 being the biggest average increase in Part-Time wage of 9.65%.

Why Do People Work Part-Time?

There are several main reasons people work Part-Time including, Economic reasons, Preference, School or children. However, it should also be noted that the most common reason for working Part Time is going to school according to Stats Canada.

This is just above the second most popular reason which is primarily seniors working Part-Time because of personal preference. Having a part-time job to go to is a great way to keep busy and get a little more money coming into the house at an older age.

No matter the reason for working Part-Time it is always a good idea to find somewhere you will enjoy working and where the hours can work around your schedule however you need them.

If you are looking for a part time position, (or full time) our friends at Jooble will help you find the perfect fit!

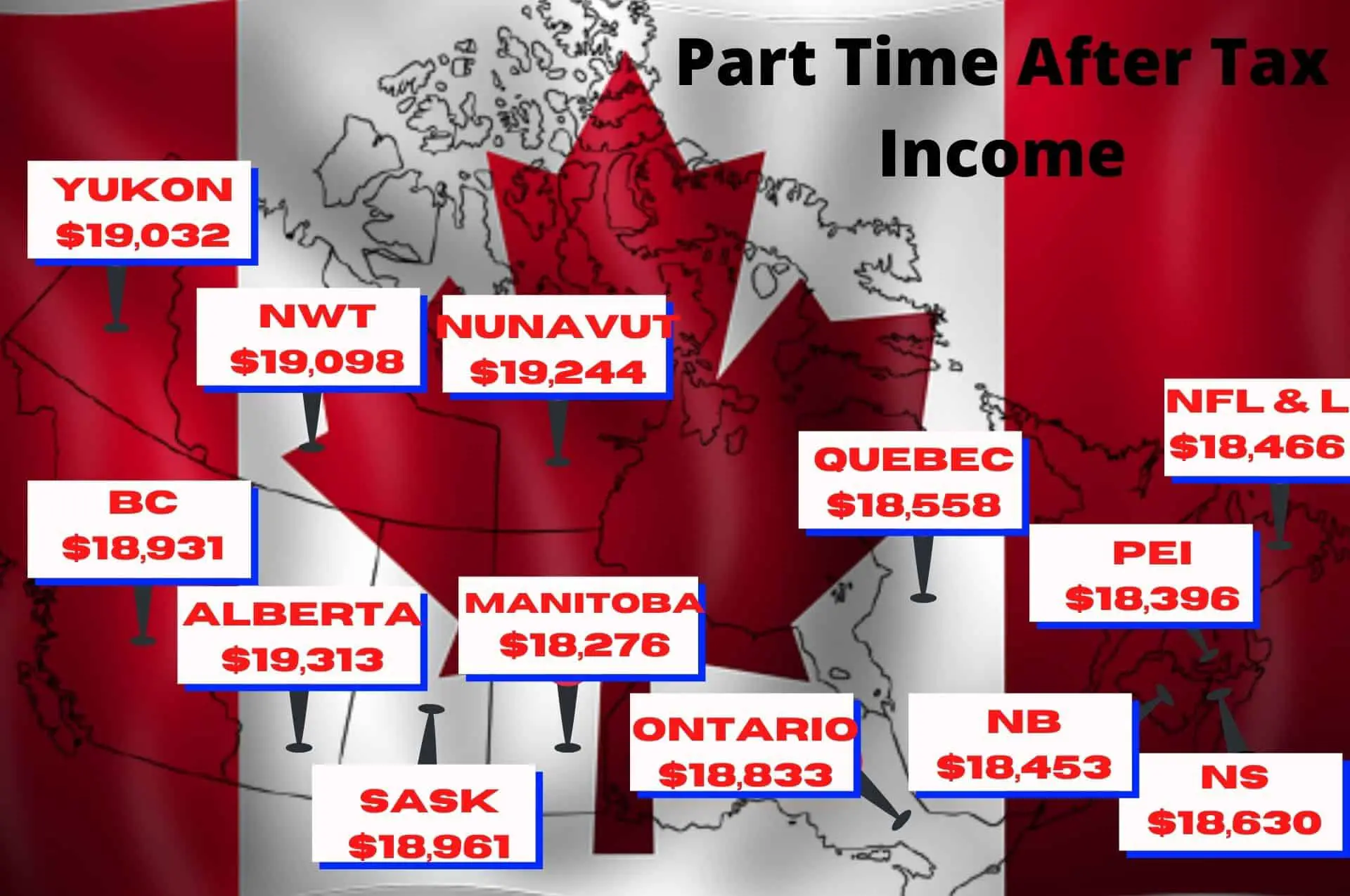

The Take Home Pay By Province

Just because the average income for a Part-time worker is $17.25 an hour doesn’t mean that you will be taking home all of that money. There is always taxes being taken off and depending on where you live in Canada will determine how much you pay in taxes.

Being that provincial taxes are different income tax in some provinces allow people to take home more money than others.

Let’s go over a few scenarios and see how much you can make in each province depending also on how many hours you work. Not all Part-Time employees work an average of 25 hours a week. You may only be able to work 10 hours or, maybe you can work 30.

The number of hours you work will greatly affect the amount you get to take home from your paycheque.

Other Posts!

Is a savings account safer than a checking account?

If you save $200 a month how much will you have?

Average Take Home Pay Working 25 Hours A Week

With the national average income for Part-Time workers being $17.25, we can get a good idea of how much money you can make per month working 25 hours a week in each Province.

AlbertaTotal income$ 21,562 Federal tax$ 870 Provincial tax$ 90 CPP/EI premiums$ 1,289 Total tax$ 2,249 After-tax income$ 19,313 Average tax rate10.43 % Marginal tax rate25.00 %

|

British Columbia

Total income$ 21,562 Federal tax$ 870 Provincial tax$ 472 CPP/EI premiums$ 1,289 Total tax$ 2,631 After-tax income$ 18,931 Average tax rate12.20 % Marginal tax rate20.06 %

|

Manitoba

Total income $21,562 Federal tax $870 Provincial tax $1,127 CPP/EI premiums $1,289 Total tax $3,286 After-tax income$ 18,276 Average tax rate 15.24 % Marginal tax rate 25.80 %

|

New Brunswick

Total income$ 21,562 Federal tax$ 870 Provincial tax$ 950 CPP/EI premiums$ 1,289 Total tax$ 3,109 After-tax income$ 18,453 Average tax rate14.42 % Marginal tax rate24.68 %

|

Newfoundland

Total income$ 21,562 Federal tax$ 870 Provincial tax$ 937 CPP/EI premiums$ 1,289 Total tax$ 3,096 After-tax income$ 18,466 Average tax rate14.36 % Marginal tax rate23.70 %

|

Northwest Territories

Total income$ 21,562 Federal tax$ 870 Provincial tax$ 306 CPP/EI premiums$ 1,289 Total tax$ 2,464 After-tax income$ 19,098 Average tax rate11.43 % Marginal tax rate20.90 %

|

Nova Scotia

Total income$ 21,562 Federal tax$ 870 Provincial tax$ 773 CPP/EI premiums$ 1,289 Total tax$ 2,932 After-tax income$ 18,630 Average tax rate13.60 % Marginal tax rate23.79 %

|

Nunavut

Total income$ 21,562 Federal tax$ 870 Provincial tax$ 159 CPP/EI premiums$ 1,289 Total tax$ 2,318 After-tax income$ 19,244 Average tax rate10.75 % Marginal tax rate19.00 %

|

Ontario

Total income$ 21,562 Federal tax$ 870 Provincial tax$ 570 CPP/EI premiums$ 1,289 Total tax$ 2,729 After-tax income$ 18,833 Average tax rate12.65 % Marginal tax rate20.05 %

|

Prince Edward Island

Total income$ 21,562 Federal tax$ 870 Provincial tax$ 1,007 CPP/EI premiums$ 1,289 Total tax$ 3,166 After-tax income$ 18,396 Average tax rate14.68 % Marginal tax rate24.80 %

|

Quebec

Total income$ 21,562 Federal tax$ 713 Provincial tax$ 896 QPP/QPIP/EI premiums$ 1,395 Total tax$ 3,004 After-tax income$ 18,558 Average tax rate13.93 % Marginal tax rate27.53 %

|

Saskatchewan

Total income$ 21,562 Federal tax$ 870 Provincial tax$ 442 CPP/EI premiums$ 1,289 Total tax$ 2,601 After-tax income$ 18,961 Average tax rate12.06 % Marginal tax rate25.50 %

|

Yukon

Total income$ 21,562 Federal tax$ 870 Provincial tax$ 371 CPP/EI premiums$ 1,289 Total tax$ 2,530 After-tax income$ 19,032 Average tax rate11.73 % Marginal tax rate21.40 %

|

As you can see if you are working the average Part-Time hours in each province even at the same hourly rate you will be taking home different amounts. This can work to your advantage as well as partially against you.

Conclusion

No matter why you want or need to work Part-Time there are options out there and jobs for you! Just remember to try and put some of your income away in an amazing savings account like CIT Banks!

You can make more than you think! Just make sure to take advantage of Compounding, this is how!