Saving money is one of the most effective ways to get ahead in life and work toward building safety nets like an emergency fund. Throughout our lives, we are told we need to save more and cut down on expenses. In reality, you don’t need to save as much money as you might think.

By saving $200 a month for a year at 1% interest you will have $2,400 plus $24 interest. If you invest that $200 a month with an investment return of 8% you will have $2,489.99 after a year and $36.589.21 after 10 years.

Why Should You Start Saving?

Most importantly saving money will help you avoid any serious financial emergency that may arise throughout your life. But saving only to protect yourself from an emergency isn’t the only reason you should be saving money. There are multiple great reasons for you to save money such as;

- For an Emergency Fund

- College/University

- A down payment on a house or vehicle

- Investments

- Children

All of these have their specific saving needs too. If you are saving for a down payment on a house. The amount you need to save can vary wildly depending on how big of a house you’re planning on purchasing or the relative market you plan on buying the house in.

Whereas, if you are saving for an Emergency Fund you will typically want between 1-6 months of living expenses saved. After saving for an emergency you may only need to save a small amount to buy that TV you always wanted.

No matter what your saving needs are there is always a good reason to try and save a little bit more.

How Much Will You Have In A Saving Account?

By saving more money over time you will be able to make that money work for you. With a traditional savings account or Money market account you will get between 0.25 and 1.5% interest on average. Of course, this all depends on the individual rates available at the time.

There will be a big difference in how much money you have after several years of saving vs. Investing. By saving $200 a month for a year, you will have $2400 but after multiple years you can have much more. Let’s look at two scenarios; one will be a savings account with an interest rate of 0.5% and the other investments with a return of 8%.

| Year | Total Saved | Total Interest at 0.5% | Total Value |

| 1 | $2,400 | $5.51 | $2,405.51 |

| 5 | $12,000 | $148.70 | $12,148.70 |

| 10 | $24,000 | $604.87 | $24,604.87 |

| 15 | $36,000 | $1,376.31 | $37,376.31 |

| 20 | $48,000 | $2,470.99 | $50,470.99 |

| 30 | $72,000 | $5,663.01 | $77,663.01 |

Saving money for multiple years will give you compound interest and after 30 years you will be getting $5,663.01 in interest and have a total investment of $77,663.01. After 30 years of saving $77,663.01 may not be enough, but how much will you have if you start investing that $200 a month?

Long Term Investing $200 A Month For A Year And More

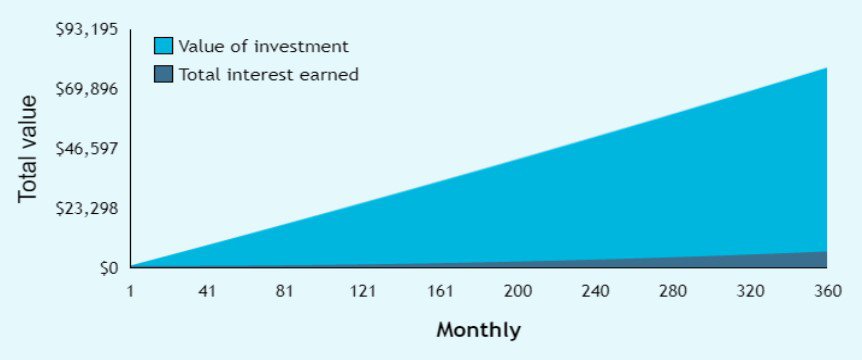

Long term investing can make you a lot more money than saving $200 a month in your savings account. The compounding interest or investment returns will grow your money faster and faster the longer you keep investing.

| Year | Total Saved | Total Interest at 8% | Total Value |

| 1 | $2,400 | $89.99 | $2,489.99 |

| 5 | $12,000 | $2,695.37 | $14,695.37 |

| 10 | $24,000 | $12,589.21 | $36,589.21 |

| 15 | $36,000 | $33,207.64 | $69,207.64 |

| 20 | $48,000 | $69,804.08 | $117,804.08 |

| 30 | $72,000 | $226,071.89 | $298,071.89 |

As you can see, even after saving money every month for one year you have a higher return because of the interest. After 30 years there is a huge difference in the compound interest effect.

Start Saving Today

Saving money every month is the key to financial freedom. You can start saving today with an amazing account like a CIT Saving Account or CIT Money Market account. Then when you are ready you can use your savings or start investing it into areas that will make it work for you.