Are you an active investor? Do you save some of your income and invest it into the stock market or into perhaps rental properties? Maybe this is something you’re interested in getting started or learning more about. Looking at it from the perspective of the entrepreneurs behind it all will help you develop and understand a good business from a poor one.

What Is The Stock Market?

A stock market is a place where buyers and sellers of stocks can purchase or sell “stock” (shares) in a public company. The stock or share is a small portion of ownership in a publicly-traded company. A company may split the ownership of the company into millions of shares allowing the potential for millions of people, entities or entrepreneurs to purchase a portion of their company.

Most of the time purchasing shares in a company is done through stock brokerages or electronic trading platforms such as Ally invest.

Ally Invest is a platform you can start using today that will help you start investing and growing your wealth. There are options for you too, you can allow ally Invest to manage your investments or you can Warren Buffett style your investments and manage them yourself.

So, investing in the stock market is purchasing portions of a company and as the value of a company increases so does the value of your investment. That being said the value of a company can go down as well, so there is always some risk that you may lose your money investing in the stock market. Don’t let this scare you away though there are a lot of ways that you can lower the risk of investment loss.

Stocks Are Businesses, Entrepreneurs Learn Business

The fact that stocks/securities are portions of a business is very important. If you can understand how a business works and how to properly evaluate a business then you can make well-informed decisions about where you place your money. This, in turn, lowers your risk of loss in the stock market.

Buy a good company that is properly managed and making money and the value will go up.

How are you going to choose which stock to purchase? Well, there are a few different ways to evaluate a business and whether to invest in it or not.

One great way is to learn about business and in turn, learn how to evaluate a business. The best way to learn about business is the entrepreneurs way, own your own business! You don’t have to quit your job or stop going places with your friends. A side gig, a side hustle, doing something like that will do two things.

- Give you some real experience with money management and running a side business, and

- Provide you with extra cash for investing purposes. (Test your knowledge)

The Entrepreneurs Way

The Entrepreneurial Way to learning about investments is reliant on a few things. You are working to develop the skills and knowledge for business. You are reviewing and following your own business’ financial situation.

These two things can make a big difference in how you invest and where you invest if you are looking to purchase an individual stock of a company. If you know how to run a company you can better judge a company based on the financial situation they are in as well as reading the literature provided by management.

What is an Entrepreneur?

I’ve been reading a great book lately called: Entrepreneurial Finance: Finance and Business Strategies for The Serious Entrepreneur by Steven Rogers.

In this book Mr. Rogers describes 2 types of Entrepreneurs, one is “The Lifestyle Entrepreneur” and the other is “The High Growth Entrepreneur”

“The Lifestyle Entrepreneur”

According to Steven Rogers, a lifestyle entrepreneur is an entrepreneur that runs a business for his/her family. This business won’t expand much beyond the reaches of their community. It will provide them with a good solid baseline of income for years but isn’t going to be the new Starbucks or Wal-Mart.

The lifestyle entrepreneur is looking for a decent standard of living. A lot of small businesses run by Lifestyle entrepreneurs may have just a vision and no real laid out plan of achievement for expansion. This doesn’t mean that their business will fail it means they don’t want to have rapid expansion like Steven Rogers second type of entrepreneur.

The High-Growth Entrepreneurs

The High-Growth Entrepreneur is just that, a business owner who wants to take their business to the masses. Not a local ma-and-pa corner store making a comfortable $100,000 a year for the owners.

No, a High-Growth Entrepreneur wants to see expansion and higher-income numbers exponentially.

These are the Businesses that are striving to have potentially hundreds of employees and have products or services sold in multiple countries. It all has to do with scale. The scalability of business will allow for rapid expansion typically this will involve investors or some other form of acquiring funding.

The Increase of Online Business

Creating a local side hustle can be a great option for a lot of people to get their feet wet in the world of understanding business as entrepreneurs. There have been quite a few people who make some good money on the side making hair bows or other items in their homes and selling them on Facebook or other platforms.

You may also start flipping items and selling them locally or on the internet which has been a great option for some people and it makes sense. You can go to local thrift stores or around to yard sales and get some amazing products for cheap. With a little time and effort, you can sell these products and make a profit.

Creating a side hustle doesn’t have to take over your day job but by managing the money you are getting a better understanding of how a business is run. Small things like this will help you learn more about Profits and loss, cash allocation, budgeting, and cash flow.

It’s getting more popular every day to create a business online. It’s quick to get going and can be done on your couch watching TV.

The Reach Has Changed

The local ma and pa restaurant has a limited number of customers based on the area it is in. The only way for a business like this to expand is to open another restaurant in another area. This is a huge reason that people don’t end up expanding into bigger markets. The internet has changed that.

The simplicity of online business has made it easier for so many people to become entrepreneurs and according to ourworldindata.org

there are 7.7 billion people in the world, with 3.5 billion of us online.

With so many people online and using the internet it’s no wonder having a website and creating an online business has gotten so popular.

No longer are you focused in such a way that the only traffic you will be able to get your product or service to is strictly local. The room for expanse is getting bigger and bigger as more and more people adopt the internet and start using its power to purchase.

You can start an online business at home in your underwear while you watch TV. No, seriously I might not be wearing any pants right now writing this. You never know.

You Don’t Even Need Your Own Products Anymore!

Long gone are the times where you have to have a ton of stock built up and try to mark up the price a little bit and sell it. There are options now to sell other people’s products and never even touch them.

Dropshipping has become wildly popular which is where you facilitate the sale of a product after marking it up and then you “purchase it” using the money from the purchase and have the company send it to your customer. You keep the difference and move on to the next sale.

A Blog is a great option to start making some side income and learn the skills to make better investments. As your blog grows and your audience gets bigger you can start using Affiliate marketing where you advertise for products or services you trust and if you make a sale you get a commission.

There are so many different options that you can take to create the wealth you want. This blog is created using WordPress hosted by Bluehost. Within a couple of hours, you can have your own blog up and running working for you while you sleep.

If you are looking for any hosting platform you won’t be able to beat Bluehost. They are one of the cheapest in the business and the service has been absolutely amazing.

Investing in the Stock Market

So how is all of this supposed to help you make better choices in the stock market when you are investing your money?

Simple, you have a better understanding of how a business is working financially. 3 main things are going to give you the most information about how a business is run.

- Balance Sheet

- Cash Flow Statement

- Income statement

These 3 documents will give you a good picture of how a business is operating. Something you should learn and use to evaluate how your business is operating. These sheets don’t have to be complicated and they shouldn’t scare you away from starting a blog with Bluehost either.

There are a lot of people who start a blog and learn about how it works, the ins and outs, before monetizing and getting involved with the financial aspect.

Understanding and being able to see for example, that a company might be able to show a profit but the cash flow is in the negative would be very helpful in choosing to invest or not.

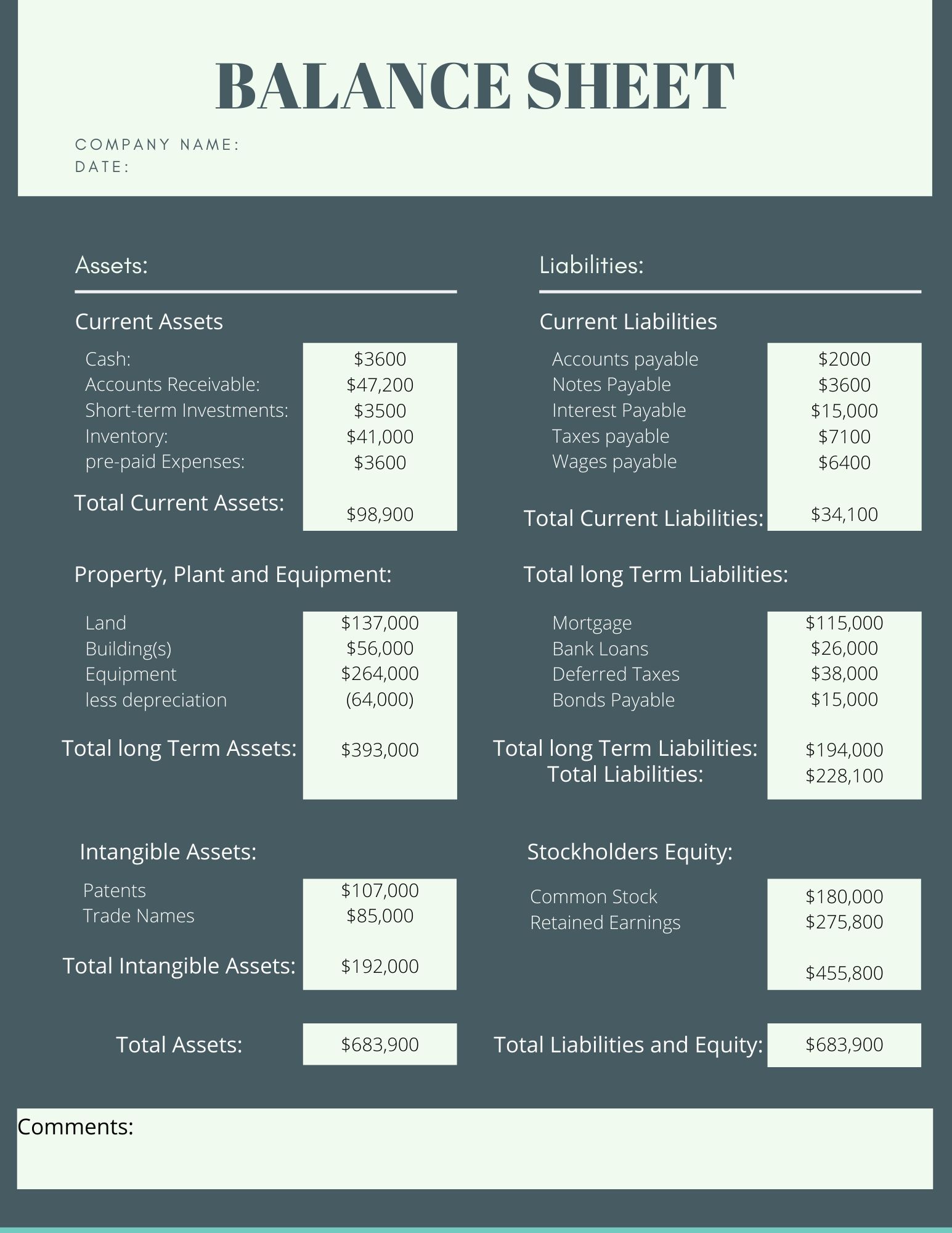

Balance Sheet

The Balance Sheet shows the Assets, equity and liabilities of a company at a specific time. It can be described as a Polaroid picture of the company in that; there is no “flow”. The Balance Sheet is a snapshot at that particular moment in time.

By itself, the Balance Sheet cannot give a true sense of how a company or business is being run. It can, however, give you a lot of very useful information through ratios and evaluating the structure of assets.

Some companies can be reliant more on Liabilities than others, such as a real estate company that may have a much higher ratio of debt to equity (D/E) than another business of similar size.

The D/E ratio for companies in the real estate sector on average is approximately 352% (or 3.5:1). Real estate investment trusts (REITs) come in a little higher at around 366%, while real estate management companies have an average D/E at a lower 164%.

For this reason, you should evaluate your business and other businesses based on their respective sector.

Because a balance sheet is a snapshot in time of a business’s Assets, Liabilities, and Equity to get a better picture and add some “flow” you can compare balance sheets over time.

By comparing multiple balance sheets over time you can see if the company is improving and growing its assets, Liabilities, and equity in such a way to create a stable business.

For a bit more information on Assets and Liabilities here are some resources:

Not All Assets Are Created Equal

Ratios

Some of the ratios that can be used to help show you the health of a business are:

shareholders’ equity

shareholders’ equity = Total assets – total liabilities

Net worth = total assets – total liabilities

Therefore Net worth = shareholders’ equity

Shareholders’ equity is the difference between total assets minus total Liabilities. Because Net Worth is the same formula as Shareholders Equity they are in fact the same metric.

Working Capital

Net working capital = current assets – current liabilities

Current Assets and Current Liabilities are expected to be paid or accumulated during the current year of business. Therefore Working Capitol is closer to a day to day metric rather than a total Net worth.

Debt to Equity Ratio (D/E)

Debt/Equity = Total Liabilities / Total Shareholders’ Equity (Net Worth)

This is the same ratio I briefly touched on involving Real estate companies which can have a very large D/E ratio. This is the relationship of debt that the company has in comparison to its equity.

Acid-test Ratio (quick ratio)

Acid-Test = Cash + Securities (bonds stocks etc.) +Accounts Recievable / Current Liabilities

The Acid Test (Quick Ratio) is used to quickly determine if a company can cover its immediate Liabilities if it needed too. An Acid-test ratio of less than 1 indicated that a company does not have enough liquid cash to be able to cover its short term Liabilities. This means the company doesn’t have enough short term assets (i.e. Cash, stocks, etc.) to pay off its immediate debt.

A balance sheet should ALWAYS “balance” so if you were to ever see one that doesn’t balance out between Assets, Liabilities, and equity there is something wrong with the numbers.

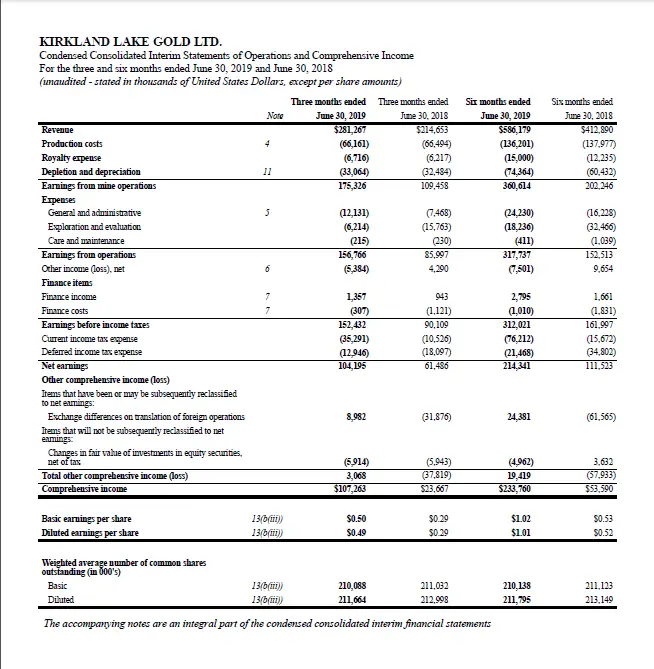

Income Statement

An income statement recounts the “flow” of money through a company. On an income statement, it shows the Profits and Expenses (revenues and expenses) for a period of time. The period of time may be a month a quarter or a year. This will be dependent upon what the entrepreneur is looking for and/or business practices.

One of the big reasons that an Income statement is useful is for calculating Net Income and EBITDA.

Net Income

Net Income= revenues – Expenses

When the income of the company (revenues are greater than the expenses the company has a profit and if there are more expenses than revenues the company has incurred a loss.

EBITDA

EBITDA = Net Earnings (profit) before Interest, (debt cost) Taxes, Depreciation, (loss of tangible asset value ex. vehicles) Amortization (loss of Intangible asset value ex. Patents)

EBITDA is the amount that the company is making before paying for nonoperational costs such as taxes etc. This is important to you the investor or entrepreneur because this will give a picture of how profitable the actual operations of the company are and how much profit can be expected from revenues.

By comparing several consecutive Income statements you can see whether a company has been improving the profitability of operations or not through Net Income and EBITDA. Another great aspect of the understanding of business is the cash flow statement.

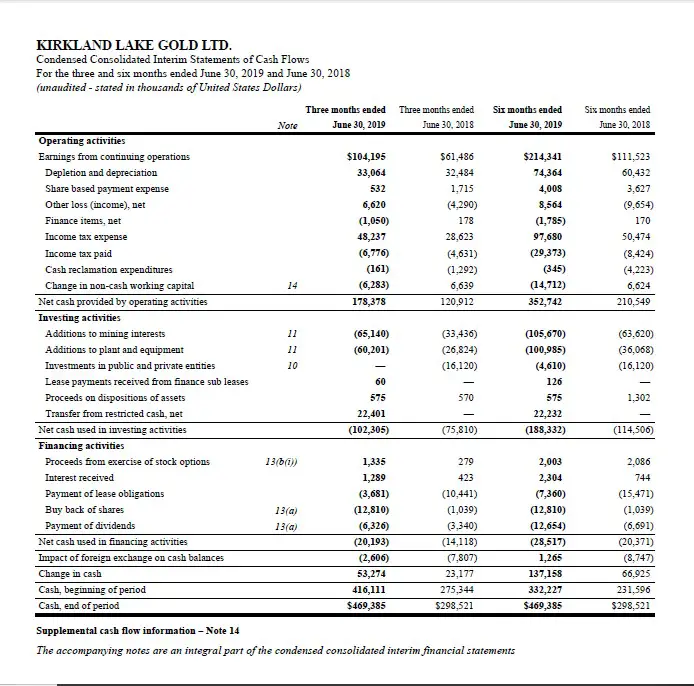

Cash Flow Statement

The cash flow statement breaks down how the cash is being acquired and where it is flowing. You can expect to see cash flows from operations, investing and financing. These activities inside of a company create inward and outward cash flow from activities such as buying equipment.

Cash flow is the blood of a company, the oil that will run its engine. It is entirely possible to have a company show a profit and not have enough cash to pay its debt. This may seem contradictory being that the company is making money but through accounting practices and company management, it is possible.

A lot of private companies try and show that they aren’t creating a profit so they pay less tax at the end of the year and generally a public company wants to show the public that it can generate big profits thereby reassuring investors of their profitability.

In reality, a company can have a lot of capital tied up in accounts receivable or inventory and not have enough cash flowing through to be able to afford its debts to suppliers or other entities.

Of course, every company wants to be cash flow positive and the simple way to calculate the cash flow of a company is:

Cash Flow

Cash at the beginning + cash received through the period – cash flow out (expenses) = next period cash at the beginning.

So naturally, after doing that calculation you can take:

Next period cash at the beginning – cash at the beginning = difference in period cash flow

Is the amount of cash flow increasing? Or are there just as many expenses as there are cash inflows?

The Watchful Eye You The Entrepreneur Needs

Studying financial papers doesn’t have to be complicated. At the very least you should be able to sit down and understand what is going on within your own company. There have been a lot of companies go broke because entrepreneurs weren’t paying close enough attention to parts of their company. (Remember you can show a profit and not have the cash to pay bills or employees)

Companies have gone broke because they didn’t have a wide enough profit margin and when sales went down so did cash flow and they could no longer afford to be in business.

Companies have gone down because they thought they were making money but their customers weren’t paying on time and they ran out of money. On the books, they had a lot of assets (accounts receivable) but the cash flow wasn’t there to support that much tied up cash.

Ponder an Adventure Into Your Own Side Business

Using your own firsthand knowledge when it comes to business can greatly help you in deciphering what a good company should be doing with its money and how to go about making sure that they are covered in the event of a downturn or loss in profits. You can start your new adventure with Bluehost and WordPress today.

Protecting the money you have has to be a priority that why so many people spend time and effort hedging their money. For more information on some of the unique points of view for an investor and entrepreneur a great book is: Entrepreneurial Finance and business strategies for the serious entrepreneur. (On Amazon.com)

And if that doesn’t seem like your style The MOST highly recommended book from entrepreneurs and MBA universities is; The Lean Startup by; Eric Ries. See my review of this amazing book!