Everyone wants to believe that they’re making good choices when it comes to investing in their future. But that’s not always the case, not all assets are created equal and you may not even know it.

You are being Lied to about your assets and it has to stop!

There are good investments and bad investments, learning the difference is the key to making more good investments and less bad ones.

Do you ever feel like you should be getting more from some of your investments? Are they all growing and making you money. That’s the point of an investment right?

To make YOU Money!

Are your Investments growing Fast enough? Are your investments where they SHOULD be? They should be in a spot to make YOU Money right?

Start your own Blog and fuel your investments with Bluehost, The only thing holding you back is starting!

For a lot of people, you may not even know where your money is…. that’s a scary thought. Where is your Money? Do you know? It’s OK if you don’t, most people don’t truly know.

It’s very easy to fall into the trap of “Buy this investment, it’s going to go up” or that one “They will make you Money!!!” Deciding on whether it’s actually a good investment or not is a whole other game.

Anyone with $100 can go spend $100 that’s the easy part.

The hard part is making sure that you are actually buying something that is or will become an Asset!

So how do you know if you have an Asset or not? You wouldn’t buy things that aren’t Assets and call them an investment, would you? Are you sure? Like really sure?

Well, to know what would constitute as a valuable Asset we should start by exploring what an Asset is and what a Liability is.

Assets and Liabilities

Assets and Liabilities make up pretty much everything. That is if you choose to look at your life that way.

It’s not just investing in the Stock Market or Income Properties. Assets and Liabilities can be implemented into people as well.

Such as That rude cashier at the shopping mall who was swearing and disrespecting the customers.

Yeah, he/she wasn’t a very good Asset to the company, even though the company made an investment into that staff member.

So how can we fully distinguish what an Asset is and how not all assets are created equal? Well, let’s start with the bad and work our way to the good.

A Liability

A Liability, you’ve heard this term before I’m sure. “You’re Liable if someone breaks their arm falling off the trampoline in your back yard.” Or such and such a company is Liable if their driver gets into a car accident.

Each of those has a Negative feel to them. It’s going to cost someone money in both of those events. There will be a debt created if those events were to happen.

Well, that’s what a Liability is, Debt. Whether you’re talking about investments or simple everyday events.

Debt needs to be repaid and under most circumstances there will be interest added to your debts(liability) which over time means that you will be paying more than the initial liability (debt).

No one wants to pay a debt because something unfortunate happened. That’s why we spend so much money on insurance or try to hedge our investments to Prevent loss.

So to make it simple,

A Liability is a debt or an obligation to repay an entity due to past transactions.

An Asset

By definition, an Asset is something that can be turned into cash or a cash equivalent.

So when you make and Investment into something like a house the value of the house is an asset. It doesn’t stop only at a house, a vehicle is an asset, land, inventory, etc. The list goes on and on, the main idea to understand is that anything that can be made into cash or money is an asset.

The relationship to cash flow

throughout this post we are talking about your assets. there are many things that affect your assets in different ways. Some Assets are better than others. A good Asset will make you more money over time. A poor Asset will cost you money over time.

This may seem like a simple explanation to try and see how good your assets are but it makes the world of difference in growing your wealth over time!

Remember;

An Asset is anything that can be converted into cash or cash equivalents (cash is also an Asset) and,

A Liability is something you owe or will owe. (costs you money)

So if we are going to determine what Assets you have, and those Assets have to be convertible into cash, let’s start with cash and what affects your cash and determine what influences are fighting you along the way to wealth.

Taxes and Inflation

Taxes, your Worst nightmare, mine too.

Taxes are everyone’s biggest expense and most people don’t even fully realize it. Think about it…

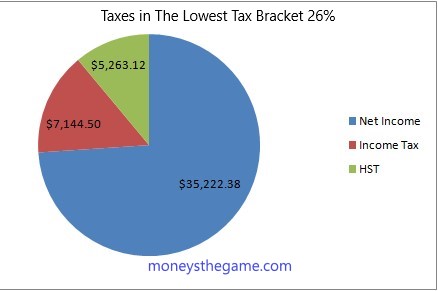

Right now in Canada, the current lowest Income Tax bracket is 15% on the first $47,630 of taxable income.

That’s $7144.50 in Income tax that you will have to pay, and that’s the Lowest income bracket!

This in turn will bring your after-tax income to $40,485.50.

It Doesn’t Stop There!

When you purchase something you get taxed as well. HST in Canada equals out to 13%.

So now when you go and spend $1000 on a new TV you actually have to pay 13% more costing you $1130.

So to make it clearer how much it costs, let’s say you spent the whole $40,485.50 including HST.

The tax portion of that $40,485.50 bill would be $5263.12. (13%)

The total tax that you would pay just to be able to spend your Entire income would end up being $12,407.62 after income tax and HST. (income tax: $7144.50 + HST: $5263.12)

That’s 26% of your income!!!!! AND, that’s the LOWEST tax bracket!

So it’s pretty clear that taxes are going to eat up a big portion of your cash Asset but what about “The Silent Tax?”

The Silent Tax

The Silent Tax???? No really, it’s a real thing. Most people know it by a different name, Inflation.

That fancy word no one thinks about. We hear about it and most of us know that it happens all the time but how does inflation affect your cash asset?

Inflation

Inflation is the reason bread costs more today than it did 10 years ago. Inflation is the reason in the 1930’s $50 was a lot of money. Now, $50 probably wont be able to take your family out for dinner.

Inflation is a measure of how much or how little prices are increasing every year.

Many things affect inflation and you can have higher inflation in specific areas because of supply and demand as well as many other factors.

The banks affect inflation by adjusting the key interest rates on loans as well as printing money. It’s part of how Banks make Money every day.

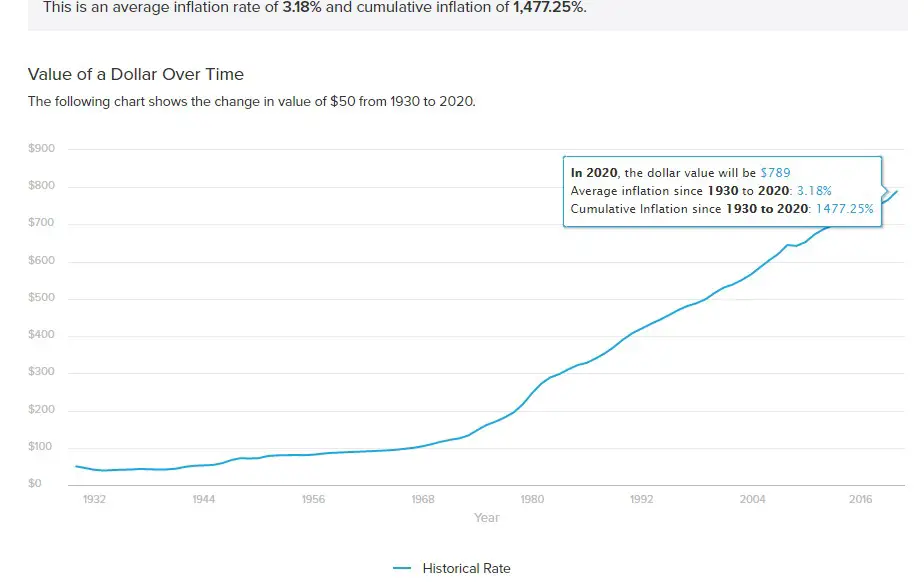

Banks and the financial wizards that control inflation want the inflation rate to be at roughly 2% per year. Currently the average inflation has been about 3.18% per year as shown in the graph. This is the affect inflation has had on $50 from 1930 until 2020.

The total value increase from $50 to a grand total of $789 from 1930 to 2020.

This is important to note because if inflation is 2%, then the price of products will double roughly every ‘‘35 years.’’

Whereas, if inflation was 8%. It would only take 9 years for the price of products to double, costing us A LOT MORE MONEY!

The Real Affects of Inflation

How Inflation affects your cash Assets is when you go to purchase something. This year it may be $10 but if the inflation rate is 2% next year the same product will be $10.20.

Your Cash is also being influenced when it sits in your bank account. Got a lot of cash sitting around? Neither do I, but if you do you may want to consider talking with your financial adviser.

Because the REAL cost of inflation is that your money has less buying power every day, every month, every year.

It isn’t that the Product price should increase by 2%.

It costs 2% MORE just to produce and deliver that product because of inflation.

The economy is constantly having more and more money poured into it through sources like Banks using Fractional Reserve Banking. Fractional reserve banking allows banks to lend out more money than they actually have “in reserve” by huge margins.

For more info on Fractional Reserve banking check out How banks take money from you every day.

The more money that gets poured into the economy the more inflation we have.

The sad truth is as the value of a dollar goes down; it can’t buy as much anymore. The more time that goes by the less buying power your dollar has.

So all of you savers out there who are rolling in cash and putting it into your bank account….. You are losing money every day to INFLATION and don’t even know it!

The imbalance of interest

The interest you are being paid by your Bank account most likely isn’t 2%, which means the buying power of your cash is steadily going down and down every year. Your Money sits there collecting interest and Losing Value at the same time.

This is costing you money (Buying Power).

Just based on inflation alone, having a Cash Asset is costing you buying power the longer it sits in the bank.

Well if having your cash sitting in the bank is costing you buying power what do you do? You go to a Financial Advisor/Investment Manager. Because after all, we can’t all be experts in Finance and people devote their Entire career and lives to helping people set proper goals and make more money.

Financial Advisors

I’m going to state right off the hop that I believe a good Financial Advisor is an extremely valuable Asset but, understanding there is a cost is important.

Understanding the cost, the flow of money(asset) is why Financial Advisors can end up costing more than they make you.

Financial Advisors are an important part of people’s futures. They work with their customers/clients (note: that is an important distinction) to create proper and realistic goals with a plan on how to achieve it.

So when it comes to your investments, you are trying to make develop assets and eliminate liabilities. That’s your advisor’s job, to guide you along the path. You don’t need to be the expert, you get to hire the expert right?

On a side note: Having more money to invest and increasing my own income has been one of the greatest journeys so far it started with designing a site on wordpress with Bluehost. You can increase your investment potential too.

Bluehost costs less than 2 coffees a month. Start your next journey.

The important distinction: customers/clients

Saying clients is a nice way of saying, the customer. In that I mean, no one works for free and no one should have to. Not you, not your Financial Advisor.

So going to a Financial Advisor will cost money. It will. There’s no way around it. And it should, they need to make a living just as much as everyone else.

Just as you go to a doctor when you’re sick or a mechanic when your car is broken you go to a Financial Advisor for expert advice and guidance.

This isn’t all bad though, their job is to make you money and you pay them to do it.

Just like paying your Mechanic to fix your vehicle makes you Money (in a roundabout way) by being able to go to work. Your Advisor should make you money by fighting inflation, taxes (through investment strategy) and creating a strong growing Portfolio.

There is always risk involved when you start investing in any area. It doesn’t matter what you invest in, there are always risks. In Real Estate the tenant may destroy the property. In stocks, the price may go down. REITs, Bonds, Mutual Funds, etc, they all have risks. They could all cost you money.

When you’re investing there are fees that you pay to your broker(s).

The thing about paying a professional is there’s a secret. (not really)

Well here’s the secret: It doesn’t matter what happens to your investment, your advisor will still get paid through fees and commission.

This isn’t really much of a secret. Your financial advisors should be explaining how they get paid for their services. If you are with an advisor that is being evasive about how they get paid for their service, you should consider finding a new one.

So, what do you need to know before you go to your advisor and say “yup, here’s my money?”

Follow the Money!

This is something my Dad has said to me on multiple occasions. “Follow the money.” If you want to know who/what you’re dealing with in any situation, Follow the Money.

What are the fees? What types of commission do you get? How do I pay you for your services? What’s happening in the background? How much will this cost?

These are some of the questions that will allow you to “Follow The Money.”

The key to understanding how an Advisor can unintentionally cause a good asset to become less than productive is the cost.

If it’s going to cost you 2% of your profit, that may not seem like too bad of a thing when the stock market has created a profit averaging between 7% and 10% every year…… But that’s an average. (And there is NO guarantee WHATSOEVER that it will continue!)

There are years the stock market doesn’t do very well, wins and losses. But remember, your Advisor will still get paid. (Follow the Money) Ask questions and get the full picture.

So let’s say your investments underperformed but still made money, yay!

Your investments went up 3%. Not too bad, but the commission is 2% leaving you a 1% gain. Your advisor made more money than you did that year… off YOUR money, That’s not cool.

On top of that Inflation being, 2% will eat that 1% and you will have lost 1% buying power making a 3% profit actually a loss in value. Do you see the problem?

Once you start following the money you find that you may not be getting such a good deal when investments underperform even though you made money.

You are also told other things are Assets. How do they stack up and affect your bottom line?

Vehicles and Toys

Vehicles are (virtually) an “every household phenomenon” that started in the early 1900s. The convenience, the luxury, the style, it all makes us want one….. Or 10!

If you went to the bank to get a loan, the broker would start asking you about what Assets you have and a vehicle would be one of those Assets. Your vehicle would count toward your Assets because it can be sold and made into cash. It counts as collateral in the event you fail to pay the loan.

Most of us have vehicles and most of us use those vehicles every day to go to school, your job, a friend’s place, to get groceries, etc. So having a vehicle is a benefit too. You use it to get to work and make money. It contributes to the production of an Asset (cash).

Vehicles also cost a lot of money. The ever-rising price of vehicles is making it harder and harder to even buy one for most people. That coupled with the depreciation just from driving off the parking lot sounds like A LOT more money going out than in.

There are a lot more people buying vehicles on credit than just outright. Of course, there is though, very few people have $50,000 sitting around to purchase a vehicle without financing.

But not only do you have to pay the $50,000 for the vehicle, but you also have to pay interest and insurance, fuel, repairs, it just keeps going.

All of these things make your vehicle cost money and not make money. This is the same for your toys. You have an awesome boat but it doesn’t make you money. Your 4 wheeler, dirt bike, side by side, they all cost you money even though they would still fall under the “Asset” column at the bank. Think about that.

What about most people’s BIGGEST investment? You know the one, your house, your home, your living quarters. Where does it sit in your “best” asset column?

Your House(s)

Well now what. Your House too?

Think about your house for a few minutes. Your house is and asset because you can sell it and turn it into cash, but, does your house make you money? Or, does your house cost you money?

Odds are. Your house Costs you money.

Houses are expensive! Mortgages, Utilities, Yard upkeep, Insurance, the costs go on and on, let alone if something breaks and now you have to pay to fix it.

So why then are you told your house is such a GREAT asset? Because you were told that I’m sure. You were told your house is an good asset. You get told this by the banks and by lenders all over.

It’s not just a bank either. It has been ingrained into our society for years and years. Our parents, grandparents, they all believed that their house was an amazing asset. Lenders love these “assets.”

If you are looking to get financing for a new vehicle you will likely get asked:

“What assets do you have?” and your reply? “A house”

You will likely hear “That’s a great asset.”

Who’s it great for? You? That house costs you money every month. It won’t help you pay for that car.

Your house is also an Asset to the BANK. It can be hard to hear but it is.

You pay the bank every month for your mortgage.

Again, “Follow the Money.”

Your Mortgage, it makes the BANK Money. This makes your Mortgage an expense to you and an asset to the Bank. Sure if you sold your house you would get the equity out of it (asset), but with interest over how many years…. and how a mortgage is structured to pay interest first.

You will end up paying a lot more over time for your house even though it’s an asset.

Your house is an asset to the Bank not just you!

What’s the point then?

The whole reason I’m sharing this information with you isn’t to make you feel bad about your decisions through life. It’s not to disappoint you or make you feel like a failure. It is simply to understand the other side of the coin.

The side where your house is actually costing you potentially more than the asset is worth and the side where you give your money to a professional, but they still need to make a living and it costs you money.

Opening your mind to how money is moving and changing is how you will benefit yourself. The biggest tool you have at your disposal is your noodle, your head, your brain. (other than the blog feed) Your brain can figure out what’s up. It’s up to you to let it.

Thinking outside the box is hard. Society is telling you one thing and other people are telling you something completely different. Knowing both sides of the story will make you better in every aspect of your life not just investing but creating goals properly so you can actually achieve them.

Looking for more great insights? Don’t forget to sign up for The latest in Financial Growt

Great work on this post – going back to the basics. The whole needs vs. wants angle is not something most people want to explore. I NEED that ATV. I NEED a bigger truck, I just got a raise! Ugh. Good job keeping it real.

Hey Thanks, il do my best 🙂

You’re doing a great job yourself, glad to see how helpful your site is. There are some great features there!