Through your life, you will get the chance to start down a path toward your retirement or just financial freedom. This is an eye-opening experience and a journey that many people give up on or don’t fully embrace. I want you to start the right way and learn all 12 rules of money!

Rules Of Money #1- Pay Yourself First

You are the one that goes to work every day, who has developed the skills necessary to make money in your chosen field. So why then do you get a paycheque and then it seems like it’s gone right away?

Most people are living paycheque to paycheque! This is a cycle that can be detrimental to your success!

If you get your paycheque and then you pay your bills ex. Electricity, water, mortgage, car payment, etc. THEN you get YOUR money, you are doing it wrong.

When you get your pay and you pay your mortgage, you are paying the bank first.

The same thing when you get your pay and you pay for your electricity, you are paying another company first.

The same goes for your car or any other expense you have. Why not pay YOU first? When you get your pay you should be taking money out right away and paying you!

After all, you worked for that money. You spent the time to train and get good at what you do. You went to work and made the money why on earth are you giving it all to the banks or other people and keeping nothing for yourself.

Or, you pay for all of those things and think “O, there’s nothing left.”

This is very common as well.

How To Fix That!

If you feel like there is nothing left for you when you get your paycheque. There are things you can do TODAY to help you never feel that way again!

Let me tell you a little story;

A man named uh… let’s say, Fred, WAS in the same boat. Fred had an awful time-saving money and being able to enjoy things he wanted to.

He would end up eventually making excuses as to why he couldn’t do this or that. But, the reality was Fred just always seemed to come up short after he got paid.

Well, the sun came out and damned it Fred didn’t get a raise at work. Whoopie! he thought all the way to the bank.

It didn’t take long though and Fred was in the same place as before. Weeks had gone by, paycheque, after paycheque comes and, goes and Fred still wasn’t able to do the things he wanted.

What do I do? He pondered. Fred was getting more money now than before but was still in the same situation. He would get paid and then the money would be gone!

So, he said NO! That’s enough!

Fred made himself give up his pay raise. He didn’t give it back to his workplace no, Fred paid himself. He got rid of the temptation to use that money.

After all, “Out of sight, out of mind”

I’m sure you know what happened to Fred. He started to have money. Slowly but surely his money was growing. Every week, every pay his savings were growing.

Then when his friends wanted to go out for 1 or… 14 beers, he could!

Just like Fred a simple change can help you or hinder you. You don’t need to have a raise at work to make this happen. See, what happened with Fred was, he got more money and spent more money.

This is a natural reaction to having more money so don’t feel bad if you relate to it. Just know this one secret!

It Works In Reverse!

If you pay yourself first a little bit off every pay you won’t even notice it’s gone. You won’t notice but your bank accounts will.

Soon you will be swimming in money and all you have to do was set up and automatic transfer from one account to another for the same day you get paid.

Start small and slowly you can increase the amount you save. As well, slowly your savings will grow!

Rules Of Money #2- Save For A Rainy Day!

Making money and of course, paying yourself first is great but why? Besides the obvious buying crap when you may or may not need it.

Save for a rainy day. You should make it a priority to save some of your money just in case something comes up. This could be an unexpected vet bill or this could be a temporary lay-off.

Right now there are millions of people out of work. People got ripped from their jobs and steady paycheques and made to stay home because of a worldwide pandemic.

Millions of people found themselves in a bad situation. No job, No Money, No Way to Pay Bills!

How can they eat? The stress levels in all of these countries increased dramatically. So, how can saving for a rainy day help when I’m talking about a vet bill that may be, $700, in comparison to a pandemic?

Simple, it doesn’t stop at a vet bill. You may be feeling the pressure from this pandemic yourself. There’s also nothing saying it won’t happen again.

Start saving some money and just know that “This is for an emergency.”

I can’t tell you the exact amount that you should be reaching for because one of the Best things about Personal Finance is, it’s Personal!

Your situation is different than mine, your stress levels, different, your need is different.

A lot of people like to have at least 2-6 months of bill payments saved and ready to go.

There doesn’t need to be a pandemic for people to get laid off. Even though a layoff may be temporary, having no or lower-income for any period can be difficult.

Start saving for a rainy day because the sun won’t shine every day.

Rules Of Money #3- Live Below Your Means!

This is a fun one, Live Below Your Means. You don’t need to be “cheap” to live below your means. That’s very important to understand.

You can still go and do things, have fun, spend some money on crap you don’t “NEED.”

Remember Personal Finance is Personal. Living below your means is just a way of conducting yourself and your spending to within reason.

By all means though, if you want to hardcore coupon and follow up on multiple fliers to make sure you get the best deals, PLEASE DO!

There’s a lot of money saving that can happen by being frugal and not spending as much for the same item.

But that’s not entirely what it’s about. You can live within your means and not have to be a hardcore coupon saver. You simply need to control your purchases.

If you get paid $2500 a month from working, living below your means is saving first, and spending LESS than what is left on everything else. Don’t take that $2500 and spend $2700 in a month. You will slowly but surely end up in a hole that you will now have to fight for years to crawl out of.

You may need to have the odd bigger expense if something comes up and that’s why saving for a rainy day is important too. Spend less, save more and;

Don’t go and use your credit card because you didn’t have the money right now.

If you don’t have the money right now, what makes you think you will have the money later?

This is one of the biggest traps people get into with credit cards. Spend money I don’t have for things I don’t need because someone else says I can.

I do believe Credit Cards are an amazing tool though so don’t count me out on them completely. I have credit and I use it responsibly. You can also benefit from Rewards Cards and such to help you save money.

Just know, don’t spend it unless you have the money to pay it off.

Spending control is what makes “Living Below Your Means” so powerful. You don’t end up in a bad spot if you can control your spending.

Rules Of Money #4- Be Persistent!

Do you remember when you were a kid being told, “You can do anything you want in this world!” At least for me, it seemed the older I got the less that was true.

The world seemed to get smaller the ideas got fewer, the learning became more specific. You may know this feeling in your life too. If you do, you are not alone.

Your life doesn’t have to be that way. You aren’t stuck. Believe me, I’m here to help you get away from that feeling and to grow but I need for you to do something for me.

Can you to do one thing? Can you guess what that one thing is?

I need you to believe….. Drum roll……….. In Yourself!

Simple, right? Not so much, but do it anyway! You really can do anything.

Do you think Warren Buffett or Bill Gates made it from luck? I don’t think so, some might.

It may seem cliché to use famous or “well off” people to prove this point so let’s look at it differently. Have you heard or maybe you’ve had the pleasure of meeting someone who was/is homeless.

Odds are they didn’t want to be homeless and they don’t want to be looked down upon, no they wanted the same thing you want. To grow and expand, becoming better and better at anything they do.

Bad situations can land people into homelessness. Do you know what it takes to make it out? Persistence.

Don’t give up. Believe in YOURSELF! You need to never stop. I have been told by most of the people I know that my personal goals are quite extreme. Which naturally leads me being told that I probably won’t achieve them.

Maybe I won’t, but I do know that I will be a hell of a lot closer than they will!

A mountain may be tall but many steps will still get you to the top! –me just now Mark Laforet

There are too many goals to go through and show how to achieve each one. But, no matter what, learn to make a goal properly and be persistent.

You will always reach the top of a mountain by taking another step. –me just now Mark Laforet

For someone who wishes to strengthen their mind, please for your sake pick up a copy of “Think And Grow Rich” by, Napoleon Hill. You will absolutely come out of that book stronger than you went in. I read it every single year just so I don’t forget the deeper hidden lessons in those pages!

Rules Of Money #5- Never Lose Money!

This would seem a simple rule, but it is more difficult than some people think. You can lose money very quickly and not even realize it. You may buy something that was a sales pitch and the product is junk or you may make an investment into some stock and the price goes down.

There are millions of ways to make money and trillions of ways to lose money.

Always take advantage of compound investing and make your money grow exponentially faster!

Be sure that when you decide to invest in something you are making an informed decision. If you want to start investing in the stock market you should be researching the companies you are going to invest in.

If you want to buy some Real Estate make sure you have the proper plan in place to take care of any issues that arise.

Do you want to start your own business? Make sure to have a plan and check if there is a market for your new business.

Making money is great but it’s not how much money you make, its how much money you keep, invest, and protect. Like the great Warren Buffett said.

“Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.” – Warren Buffett

You should also learn more about hedging (protecting) your investments from loss. Because after all, there’s no point in investing if you’re going to lose money.

Rules Of Money #6- Use A Budget!

Creating a sold budget doesn’t have to be daunting or difficult. There are plenty of different budget styles to choose from or even blend to create the perfect one for your situation. Some of these budgets are:

-Monthly budgets

-the envelope method

-long term goal budget

-50/30/20 budget

-Barebones budget

-High saving budget

Monthly Budgets

Creating a monthly budget is simple and one of the most common methods used by many people today.

The idea is simple. Break down your expenses every month and manage what bills or expenses get paid when throughout the month. This will change based on when or how much you get paid during certain periods throughout the month. Whether you get paid monthly, weekly, biweekly, or even yearly. For more information read our budget breakdown.

The Envelope Method

This method of budgeting is a little dated but still has some benefits that can work especially in conjunction with other budgets. The basis of this budget is that you allocate all of your different expenses into “envelopes” and pay each one out of them. In doing this you can have an envelope for your mortgage, car payment, insurance, food, etc.

There is an amount of control you get with this method that doesn’t go along with some of the other methods because the money’s in your hand not viewed on a screen. This can make you more accountable for where all of your money is going and an envelope budget can be easily set up

Long Term Goal Budgets

Long term goal budgets are budgets that are set up for the money you have after all of your expenses. What will you do with all of the “extra” money you have after you pay for everything? This isn’t just about retirement, smaller goals are a big factor here too. Perhaps you want a new car, a TV or to be able to go on a trip every year.

This is where all that can happen and it will give you a visual of how much and how long it will take to achieve your goals.

50/30/20 Budget

The 50/30/20 budget was created by Elizabeth Warren, an American politician and former law school professor who specialized in bankruptcy. In this budget, you break down our expenses into 3 categories:

- Needs

- Wants

- Savings

This is effective because it controls the expenses that are a necessity but allows for the freedom to do whatever we want up to a certain point in our budget.

Barebones Budget

The barebones budget is a budget where you cut out everything that isn’t necessary. All expenses that can be shed are tossed aside and eliminated. This is a very difficult budget for anyone to do but the results will be drastic. Too much of our lives are spent… spending money. When we eliminate as many factors that are costing money as we can and lower even more of the ones we can eliminate, big things happen. If you are very far in debt and are willing to work hard and fight to get out of debt, consider the Barebones budget, and eliminate that debt as fast as possible.

High Saving Budget

The high savings budget is all about how much money we can put away for the long term. The way that this budget system works is by eliminating and lowering as many expenses as possible throughout the month and taking 5% of your total income as “fun” money. This can be hard and it means being very frugal.

Being frugal can be very addicting and satisfying not just because you’re saving money but because you have a deep appreciation when you save a little here and a little there. At the end of the month, it does pay to lower expenses and start saving as much as possible.

Rules Of Money #7- Track Your Money Problem Areas!

If you have taken the time to work out a budget or to even just examine your current budget you may start to see some patterns or things you want to improve.

You may want to buy less takeout food or lower your beer fund a little bit. You need to keep track of these areas you want to improve and work at them all the time.

Don’t just start your budget and go “cool it will all take care of itself now”

Your budget is for you to make your life easier but you still need to be using it. It will take some time to get used to using your budget but that’s good. You are making a lasting change that will better yourself for years to come.

You will find that over time it’s easier and easier to mold those habits and tendencies to give you more freedom with your money.

Rules Of Money #8- Don’t Judge Where You’re Starting From

We all start our journeys in different places and one thing may work for you and not for me.

Don’t let this get to your head. You CAN do this and you WILL succeed.

The point of all of this is to start and keep going. If you judge where you are and see others that have started and might be ahead of you it will be discouraging.

Don’t think about where you are all you need to do is use each of the 12 Rules of Money and start working to make your budget and money habits better.

We all put our pants on one leg at a time. Remember that when you see others who seem like they are farther ahead of you. Your journey is different than theirs. You can start in a different location and end in an exponentially better one with the right attitude!

Don’t give up and don’t be too hard on yourself.

Rules Of Money #9- Never Stop Learning!

There is so much information out there at your fingertips and most people just waste their time watching cat videos. Number 9 of our rules of money is about no more cat videos.

Start learning something that interests you and keep going. The rabbit hole of learning is a deep one and once you get a taste of how far you can go with the right information you will become addicted.

When you were younger you may not have liked school but now you get the choice. In school, you had to learn what you were being taught even if you didn’t care.

You can choose now. Choose something that you enjoy and something that piques your interest.

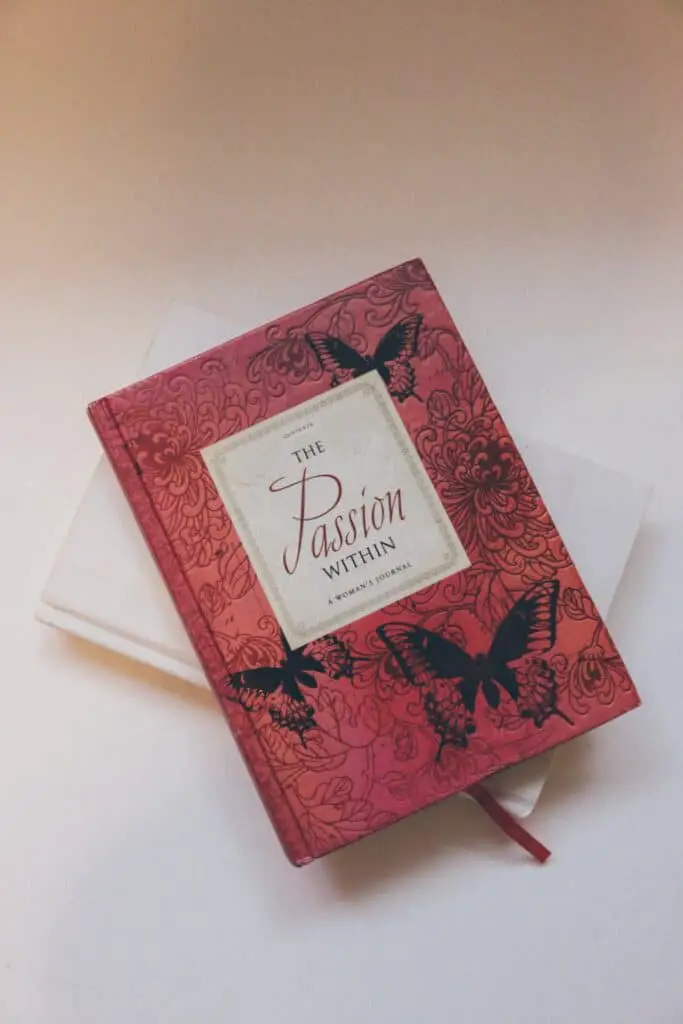

One of the best things you can do is start reading. There are thousands of years of information stored in books. People spent their entire lives learning something and put it into a book just for you!

You simply need to read and learn the information YOU like!

Reading is by far one of the best ways to get information and one of the easiest too. You can get some amazing books at the Readers Nook and start right now.

Use The Information

It’s not enough to read and know something. You need to start using this information. Get Rich Dad Poor Dad one of the bestselling books of all time.

Read it and start trying to implement some of the information presented to you.

There are years of life-changing information in books such as;

Rich Dad Poor Dad- Robert Kiyosaki

Think And Grow Rich- Napoleon Hill

I Will Teach You To Be Rich- Ramit Sethi

The Total Money Makeover- Dave Ramsey

The Intelligent Investor- Benjamin Graham

Start learning now and use that information to make your life better in every way possible!

Rules Of Money #10- Find A Passion

This Rule of Money is why Personal Finance is so Personal. You need to be comfortable and growing all the time.

Make what you’re learning, how you’re learning it, and how you’re using that information in your way.

Find the information that fits into your groove and use it. You don’t need to learn calculus if you don’t want to, this isn’t high school all over again.

You should be finding your passion inside and outside of your money. Find the passion to learn about anything from energy to coloring. Anything you like is the best thing to learn.

Having a passion for something will keep you on track, make learning about it easier, and can help you build goals the right way for your future. Don’t skimp on you when you want to develop something new.

Rules Of Money #11- Start Today

The hardest part of learning and using information is starting. Stop making excuses and start making progress.

No longer will “I don’t have time” be a valid excuse. You have time if you prioritize yourself to becoming better.

If you want to start today but you aren’t sure where to begin. Start here: get one of the books I mentioned earlier and every day read 5 pages.

That’s it, 5 pages.

You can put the book down after 5 pages if you want but challenge yourself not to. Read a bit more and a bit more. It’s not about how long or how much you read it’s about STARTING!

If you only read 5 pages every day and you do it every day for a week, You Started 7 times!

Start, Start, Start, that’s where everything begins and time will go by any way you might as well be using it to your advantage.

Start reading, start a side hustle, Start a drawing Start writing Start learning a new skill, language, or anything you have a passion for.

Rules Of Money #12- Help Others

This might be the most important rule of money. Help others.

You are going to start a journey with your money and it’s also a journey that everyone else is on. Helping people through your life is the best, most soul building thing you can do.

Not everyone can be ahead all the time and even simple things like buying someone’s coffee that is behind you in the drive-through can change someone’s life.

You are going to be building the skills and developing the knowledge that so many people can use. Spread the joy and happiness to others and GREAT things will come to you.

Rules To Remember!

No matter what you do you need to be making your life better. Use each of the 12 Rules of Money to make your life better and easier for years to come.

Don’t forget your fellow beings, they can use some love too. Build a budget and you will be growing your money faster and with less stress.

Always, spread what you learn with the people around you. Trust yourself and start building the best investments today!

These are all good rules to live by. Never lose money is a tough one though if you are in the stock market.

For sure it can be difficult. Finding great investments is the safest option.

There’s 3 ways to lose money in the market.

1) the price goes down and you sell at a loss

2) the company goes bankrupt

3) the price goes down and doesn’t recover for an unforseeable amount of time.

If you are interested the best resource I have found on finding good stock is by investmenttalkk you can take a look right here: https://bit.ly/36PBYQc

I am glad that you included the importance of helping others. Life doesn’t owe us anything but we owe it to humanity to help. Especially because we are in a financial position to do so. After paying off debt and fully funding an emergency account, of course. Happy health and savings!

Absolutely, it’s not enough just to horde money.

The best way to get money is to be helping people.

Like anything you have to stay within the boundaries of what is feasible but you will find more joy from helping rather than hording